US banks - A full 68% of negative comments online about the US financial sector are attributed to just two banks, CitiBank and Bank of America – What was going wrong?

American Express (Amex) accounted for highest share (30%) of positive customer comments online.

Columbus, OH. 15 August –Social media research specialist DigitalMR releases latest findings on what customers are saying about US financial service companies online.

DigitalMR analysed thousands of customer comments about high street banks for the month of June 2011. Over half of these customer views are negative, compared with 45% being about positive customer experiences.

The four most mentioned banking brands, with the highest number of consumer comments were: CitiBank (32%), Bank of America (23.50%) followed by American Express and Wells Fargo (both 17%).

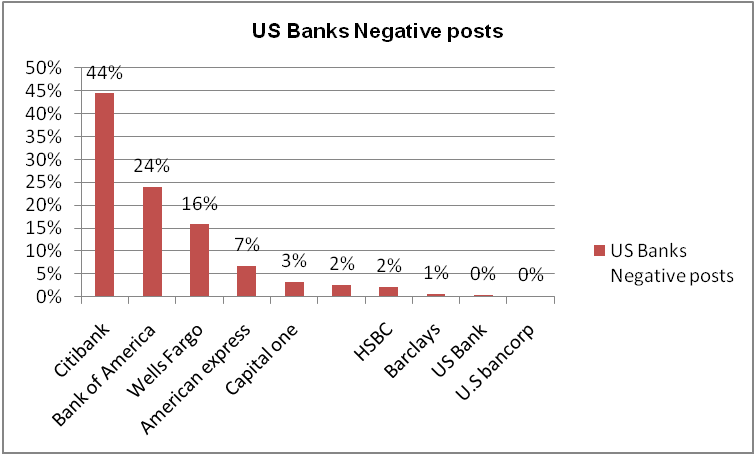

There was, however, a large difference between the positive and negative mentions that these banks generated. American Express (30%) and Bank of America (23%) attracted the largest proportion of positive posts but Bank of America also attracted the second highest number of negative comments (24%). By comparison the bank that had the highest proportion of negative posts was Citibank (44%).

Taking the difference in positive and negative posts into consideration the clear winner for June was American Express with a Net Sentiment Score (NSS) of 58% followed by Capital One with 19%. The high NSS score for American Express shows an overall high satisfaction level for users of this service.

The two banks with the lowest net-sentiment score were CitiBank (unsurprising, perhaps, given its proportion the total negative posts) with a NSS of -52% and US Bank which achieved a score of -59%. CitiBank’s higher rating is attributed to the fact that although they were the subject of the highest amount of negative comments they also were the subject of 17% of all positive comments about financial service providers. Much of the negative commentary was related to the June revelation that hackers had accessed 200,000 Citibank account holders’ details.

The banks with the highest and lowest rated NSS scores remain unchanged from April, the date of our last syndicated report, when American Express led the group, and US Bank brought up the rear.

The US Banking Sector should take note that of the ten banks we analysed conversations about, seven have either a neutral or negative NSS. This means that overall the majority of people were using social media far more to criticise than compliment their banking service.

DigitalMR’s report (powered by SocialNuggets) analyses thousands of customer comments posted via a range of relevant finance related websites and open access social media platforms. It measures not only the number of comments posted by consumers on the internet, but also sentiment – whether these posts are positive or negative.

Results are based on comments posted by consumers on the major US banks: CitiBank, Bank of America, Wells Fargo, US Bank, American Express, HSBC, Capital One, Barclays, JP Morgan Chase Manhattan and US Bancorp.

Ryan Rutan, President of DigitalMR USA commented: “the findings indicate that American consumers who utilize social media platforms are voicing frustrations about their banking experience at a higher rate than positive experiences, but that certain brands are achieving a net positive sentiment. This tells us that although the balance of comments are on the negative side, it is not strictly an outlet for dissatisfaction. This is easily seen in the divergence of the findings related to CitiBank and American Express. While conversations about CitiBank accounted for nearly a third of all mentions of companies in the sector (suggesting a wide exposure), they were negative 76% of the time. By contrast American Express should be pleased to see while they accounted for a lower total volume of posts, that 79% of comments about their bank were positive. Amex has, for the second time this year, the highest net sentiment score of all banks we monitored.”

1) Net Sentiment Score (NSS)

Most of the banks we measured, achieve a negative Net Sentiment Score (NSS) for June. NSS provides an overall percentage score of net positive posts. A positive score means a bank attracts more positive than negative posts, while a negative score suggests a higher proportion of negative posts.

The average NSS taken across all banks measured is -10%, which shows that US consumers continue to see social media as a space to share experiences of frustration and unhappiness with the service they had experienced. This is a lower NSS however than the results from our December 2010 analysis which showed in the four months from July – October the cumulative NSS for US banks was -28%.

Net Sentiment Score ranking

1st American Express (Amex): 58%

2nd Capital One: 19%

3rd US Bancorp: 7%

4th JP Morgan Chase Manhattan: 0%

5th Wells Fargo: -2%

6th Barclays: -11%

7th Bank of America: -12%

8th HSBC: -34%

9th Citibank: -15%

10th US Bank: -51%

2) Breakdown of positive and negative posts

3) Features and Services

DigitalMR measured thousands of customer posts across June regarding the services and features that banks offer. Services attracting a much higher proportion of positive mentions to negative ones were: Credit Card Incentives (18% positive vs 1% negative).

The service attracting a higher proportion of negative comments was Credit Cards with (26% positive vs 19% negative) This was followed by conversations about mortgages which displayed a negative sentiment being 17% of all negative conversations regarding a particular service.

4) In their words –customer comments

Capital One

CitiBank

US Bank

5) How can Banks use social media to their advantage?

Banks can use analysis of data from websites and other social media in the following ways:

- Engage in a one-to-one dialogue with their customers and respond to negative comments.

- Invite some of the customers to join online forums and chat groups to further express their views

- Positive sentiment can be leveraged in advertising

- Operations can learn about and fix specific branch performance issues

- Financial products can be adjusted, and new ones can be designed to meet customer needs

About the syndicated banking report

The monthly banking report monitors thousands of customers’ online conversations through comments posted on open-access social media platforms such as Twitter and Facebook, forums, blogs, microblogs and commercial websites, for US banking services.

The report is available on annual subscription with updates provided on a quarterly, monthly or weekly basis. Results will be updated to the press on a monthly basis.

Contact

For regular reports and more information:

Ryan A. Rutan

rrutan@digital-mr.com

tel: +1 (614) 638-0216

www.digital-mr.com

About DigitalMR

DigitalMR understands what people think and feel when they share views online. It is a specialist agency which provides a holistic approach to web based market research. It specialises in utilising social media research, especially active web-listening, and online communities to enhance its business consulting approach. The agency has pioneered new methods in online focus groups alongside tools such as video diaries, bulletin boards and online ethnography. DigitalMR is headed by founder and MD, Michalis Michael and has offices in London UK, Nicosia Cyprus, and Columbus Ohio, in the US.

About SocialNuggets

SocialNuggets technology delivers real-time market intelligence for fast moving industries by analyzing data from various social media sources with a mission to liberate social media data and sentiment analysis for use in real-time research of brands, products and features. SocialNuggets delivers ready to use market intelligence for various industry verticals including consumer electronics and banking. SocialNuggets data is delivered in bite size, ready-to-consume, infographics and is also available in the form of a full access to our data warehouse for analysis and integration with customers’ data. SocialNuggets, a Serendio company, was founded in 2011 with headquarters in Santa Clara, CA.

Share this article: